1. The Ultimate Guide To Affordable Longterm Disability Insurance

When it comes to protecting your financial well-being and securing your future, long-term disability insurance is an essential consideration. This comprehensive guide will walk you through the ins and outs of affordable long-term disability insurance, empowering you to make informed decisions and ensure peace of mind.

Understanding Long-Term Disability Insurance

Long-term disability insurance provides a safety net for individuals who become unable to work due to an injury or illness. It offers financial support to cover living expenses and maintain your standard of living during an extended period of disability. Understanding the key aspects of this insurance is crucial for effective planning.

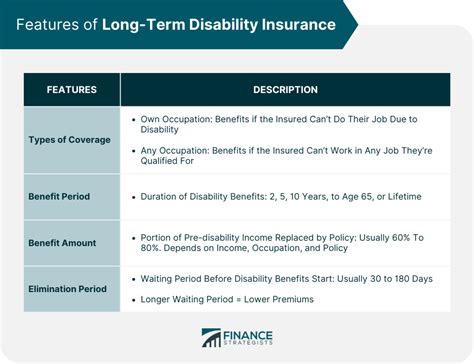

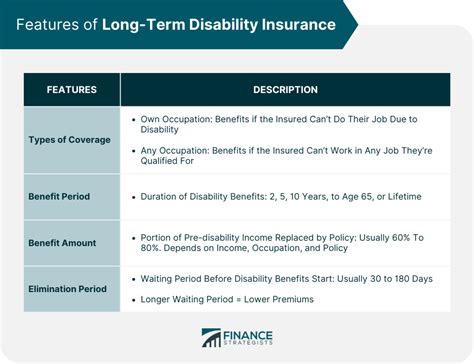

Coverage and Benefits

- Long-term disability insurance typically replaces a percentage of your income, ranging from 50% to 60%.

- The benefit amount is calculated based on your earnings and the policy's provisions.

- Policies often include a waiting period before benefits kick in, ranging from 90 days to a year.

- Coverage duration varies, with some policies offering benefits until retirement age.

Eligibility and Underwriting

Insurance companies assess your eligibility and risk factors through a process called underwriting. This involves evaluating your:

- Age

- Health status

- Occupation

- Medical history

- Lifestyle factors

Based on these factors, insurers determine your premium rates and coverage limits.

The Importance of Affordable Insurance

Affordability is a key consideration when choosing long-term disability insurance. Here's why it matters:

Budget-Friendly Protection

- Affordable premiums ensure you can maintain coverage without straining your finances.

- Lower-cost options allow you to allocate resources to other essential expenses.

Long-Term Financial Security

Long-term disability insurance provides:

- Income replacement during extended periods of disability.

- Financial stability, enabling you to meet basic needs and maintain your lifestyle.

- Peace of mind, knowing you're prepared for unexpected circumstances.

Factors Affecting Affordability

Several factors influence the cost of long-term disability insurance. Understanding these factors helps you make informed choices:

Policy Design

- Benefit Amount: Higher benefit amounts generally result in higher premiums.

- Waiting Period: Shorter waiting periods may increase premiums.

- Coverage Duration: Longer coverage periods can impact affordability.

Personal Factors

- Age: Premiums tend to increase with age, as the risk of disability rises.

- Health and Medical History: Pre-existing conditions or a history of illness may affect eligibility and cost.

- Occupation: High-risk occupations often require higher premiums.

Market Competition

Comparing quotes from multiple insurers is essential. Market competition can drive down prices, offering you more affordable options.

Tips for Finding Affordable Insurance

Securing affordable long-term disability insurance requires careful consideration and comparison. Here are some tips to guide you:

Research and Compare

- Obtain quotes from various insurers to assess premium differences.

- Compare policy features, including benefit amounts, waiting periods, and coverage duration.

- Consider the financial strength and reputation of the insurance company.

Customize Your Policy

Tailor your policy to your specific needs and budget:

- Opt for a longer waiting period if you have savings or other income sources to cover initial expenses.

- Choose a benefit amount that aligns with your financial goals and obligations.

- Consider additional riders or endorsements to enhance coverage.

Group Plans

Explore group plans offered by your employer or professional associations. These plans often provide more affordable coverage due to the larger pool of participants.

Seek Professional Advice

Consulting with an insurance broker or financial advisor can provide valuable insights. They can help you navigate the complex world of insurance and find the best options for your circumstances.

The Application Process

Once you've found an affordable long-term disability insurance policy, the application process begins. Here's what to expect:

Application Form

Complete an application form, providing detailed information about your:

- Personal details

- Occupation

- Health status

- Medical history

Medical Examination

In some cases, the insurer may require a medical examination to assess your health and risk factors. This helps them determine your eligibility and premium rates.

Underwriting Review

The insurer's underwriting team will evaluate your application and medical examination (if applicable). They'll assess your risk profile and determine the terms of your policy, including premium rates and coverage limits.

Maintaining Your Policy

After securing your long-term disability insurance policy, it's important to maintain it effectively. Here are some key considerations:

Premium Payments

- Ensure timely premium payments to avoid policy cancellation.

- Consider setting up automatic payments to avoid missed deadlines.

Policy Review

Regularly review your policy to ensure it aligns with your changing needs and circumstances. Life events such as marriage, divorce, or a new job may impact your coverage requirements.

Policy Updates

Keep your insurer informed of any significant changes in your health, occupation, or personal circumstances. These updates may affect your coverage and premium rates.

Additional Coverage Considerations

When evaluating long-term disability insurance, consider these additional factors to enhance your protection:

Residual Disability Coverage

This coverage provides benefits if you're able to work part-time or in a reduced capacity due to a disability. It supplements your income during partial disability.

Own-Occupation Coverage

Own-occupation coverage pays benefits if you're unable to perform the duties of your specific occupation, even if you can work in a different field. It provides more comprehensive protection.

Inflation Protection

Inflation protection adjusts your benefit amount over time to account for rising costs. This ensures your benefits keep pace with inflation and maintain their purchasing power.

Conclusion

Affordable long-term disability insurance is a vital component of your financial security plan. By understanding the key aspects of this insurance, considering your personal circumstances, and shopping around for the best deals, you can secure the protection you need without breaking the bank. Remember, peace of mind and financial stability are within reach with the right long-term disability insurance coverage.

What is the average cost of long-term disability insurance?

+The average cost of long-term disability insurance varies based on individual factors such as age, health, and occupation. Premiums can range from a few hundred dollars to several thousand dollars annually.

Can I get long-term disability insurance with pre-existing conditions?

+Yes, it is possible to obtain long-term disability insurance with pre-existing conditions. However, the availability and cost of coverage may be affected. It’s essential to disclose all relevant information during the application process.

How long does it take to receive benefits after a disability claim?

+The time it takes to receive benefits after a disability claim can vary. It depends on factors such as the waiting period specified in your policy and the insurer’s processing time. Typically, benefits start after the waiting period has elapsed.

Can I cancel my long-term disability insurance policy?

+Yes, you can cancel your long-term disability insurance policy. However, it’s important to understand the potential consequences, such as losing coverage and any associated benefits. Consult with your insurer or a financial advisor before making a decision.

What should I do if I have a dispute with my insurer regarding a claim?

+If you have a dispute with your insurer regarding a claim, it’s crucial to communicate your concerns and provide supporting documentation. You may also consider seeking assistance from an insurance advocate or legal professional to resolve the issue.