2. 10 Powerful Strategies For Prolevel Minimum Wage Management Now

Introduction to Minimum Wage Management

In today’s business landscape, managing minimum wage is an essential aspect of running a successful and compliant organization. With increasing focus on employee rights and fair labor practices, it is crucial for employers to stay updated with the latest regulations and implement effective strategies for minimum wage management. This comprehensive guide will provide you with ten powerful strategies to enhance your minimum wage management skills and ensure a fair and productive work environment.

Understanding Minimum Wage Laws

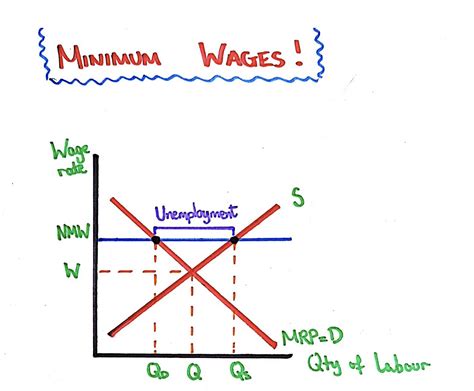

Before delving into the strategies, it is vital to have a solid understanding of minimum wage laws. Minimum wage laws are legal requirements set by governments to establish the lowest hourly, daily, or monthly compensation that employers must pay to their employees. These laws aim to protect workers from exploitation and ensure a basic standard of living. Familiarize yourself with the following key aspects:

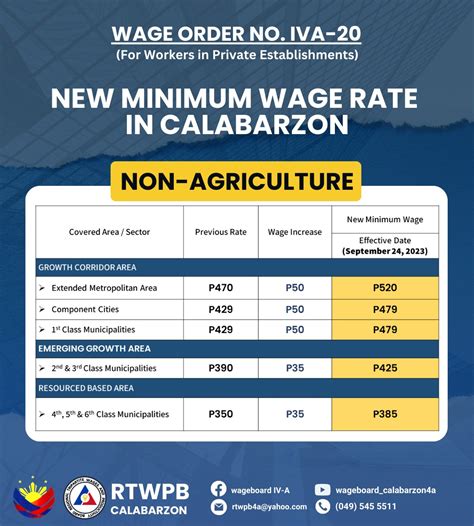

- Federal and State Laws: Minimum wage laws vary across countries and regions. Research and stay updated with the federal and state-specific minimum wage regulations applicable to your business.

- Wage Determination: Understand the factors that influence minimum wage, such as industry, occupation, and geographic location. Some industries may have higher minimum wage rates due to the nature of work or skill requirements.

- Exemptions and Exceptions: Certain categories of workers may be exempt from minimum wage laws, such as tipped employees, trainees, or specific occupations. Be aware of these exceptions to ensure compliance.

- Regular Reviews: Minimum wage rates are subject to periodic adjustments. Stay informed about any changes and ensure that your wage practices align with the updated regulations.

Strategy 1: Conduct a Wage Audit

A comprehensive wage audit is an essential step in minimum wage management. It involves reviewing and analyzing your payroll practices to identify any potential discrepancies or non-compliance issues. Here’s how to conduct an effective wage audit:

- Review Payroll Records: Examine your payroll records, including time sheets, attendance records, and wage statements. Ensure that the recorded hours match the actual hours worked and that the wage rates comply with the applicable minimum wage laws.

- Identify Discrepancies: Look for any inconsistencies or errors in wage calculations, overtime payments, or bonus structures. Address these issues promptly to avoid legal complications.

- Consult Legal Experts: Engage legal professionals or HR consultants specializing in labor laws to guide you through the audit process and ensure compliance. They can provide valuable insights and help you navigate complex regulations.

- Implement Corrective Measures: Based on the findings of the wage audit, implement necessary corrective actions. This may include adjusting wage rates, rectifying errors, or implementing new policies to ensure ongoing compliance.

Strategy 2: Develop a Comprehensive Wage Policy

A well-defined wage policy serves as a framework for fair and consistent wage practices within your organization. It provides clarity to both employees and management, ensuring a transparent and equitable compensation system. Consider the following steps to develop an effective wage policy:

- Define Wage Structures: Establish clear wage structures for different job roles and levels within your organization. Consider factors such as skill requirements, market rates, and the organization’s financial capabilities.

- Set Minimum Wage Rates: Determine the minimum wage rates for each job role, ensuring they comply with the legal requirements. Communicate these rates to your employees and provide them with a clear understanding of their wage expectations.

- Performance-Based Incentives: Implement performance-based incentives or bonuses to motivate employees and reward exceptional performance. Ensure that these incentives are structured fairly and do not violate minimum wage laws.

- Regular Review and Updates: Regularly review and update your wage policy to stay aligned with changing regulations, market trends, and the organization’s growth. This ensures that your wage practices remain competitive and fair.

Strategy 3: Implement Time Tracking Systems

Accurate time tracking is crucial for minimum wage management, as it ensures employees are compensated fairly for the hours they work. Implement efficient time tracking systems to streamline the process and minimize errors:

- Choose Suitable Software: Select time tracking software or applications that are user-friendly, accurate, and compliant with minimum wage laws. Ensure that the software integrates seamlessly with your payroll system.

- Employee Training: Provide comprehensive training to your employees on how to use the time tracking system effectively. Educate them on the importance of accurate time recording and the potential consequences of errors.

- Supervisor Oversight: Assign supervisors or managers to oversee and approve time entries. This ensures accuracy and accountability, preventing potential misuse or errors.

- Regular Audits: Conduct periodic audits of time records to identify any discrepancies or potential fraud. Take corrective actions promptly to maintain the integrity of your time tracking system.

Strategy 4: Foster Open Communication

Effective communication between employers and employees is vital for successful minimum wage management. Encourage an open and transparent dialogue to address concerns, provide clarity, and build trust:

- Regular Meetings: Schedule regular meetings or town hall sessions to discuss wage-related matters, changes in minimum wage laws, and the organization’s wage policies. This provides an opportunity for employees to voice their concerns and seek clarification.

- Transparent Pay Structures: Share wage structures and salary ranges with your employees, ensuring they understand their compensation packages. Transparent pay structures foster trust and reduce the risk of misunderstandings.

- Feedback Channels: Establish multiple feedback channels, such as suggestion boxes, employee hotlines, or anonymous surveys, to encourage employees to report any wage-related issues or concerns. Promptly address these issues to maintain a positive work environment.

- Wage-Related Training: Conduct training sessions or workshops to educate employees about minimum wage laws, their rights, and the organization’s wage policies. Empowering employees with knowledge can prevent potential disputes.

Strategy 5: Stay Updated with Legal Changes

Minimum wage laws are subject to frequent changes and updates. It is crucial to stay informed and adapt your wage management practices accordingly:

- Subscribe to Legal Updates: Subscribe to legal newsletters, websites, or platforms that provide timely updates on labor laws and minimum wage regulations. Stay ahead of any changes to ensure compliance.

- Attend Industry Events: Participate in industry conferences, seminars, or webinars focused on labor laws and minimum wage management. These events provide valuable insights and networking opportunities with experts in the field.

- Engage Legal Advisors: Maintain a close relationship with legal advisors or labor law specialists who can guide you through complex legal changes. They can provide personalized advice and ensure your wage practices remain compliant.

- Regular Policy Reviews: Schedule regular reviews of your wage policies and procedures to align them with the latest legal requirements. This proactive approach minimizes the risk of non-compliance and potential legal issues.

Strategy 6: Utilize Technology for Efficiency

Embrace technology to streamline your minimum wage management processes and enhance efficiency:

- Payroll Software: Invest in robust payroll software that integrates time tracking, wage calculation, and compliance features. This automation reduces the risk of errors and ensures accurate wage payments.

- Mobile Apps: Utilize mobile applications that allow employees to clock in and out, track their hours, and access their wage statements. These apps provide convenience and real-time visibility for both employees and management.

- Data Analytics: Leverage data analytics tools to gain insights into wage trends, overtime patterns, and productivity metrics. Analyzing this data helps identify areas for improvement and optimize your wage management strategies.

- Cloud-Based Solutions: Consider cloud-based payroll and time tracking solutions that offer scalability, security, and remote access. This enables efficient collaboration and data sharing across different departments and locations.

Strategy 7: Train and Educate Employees

Educating your employees about minimum wage laws and their rights is essential for a harmonious work environment:

- Mandatory Training Sessions: Conduct mandatory training sessions for all employees, covering minimum wage laws, their rights, and the organization’s wage policies. Ensure that employees understand the importance of compliance and their role in maintaining it.

- Ongoing Awareness Campaigns: Launch awareness campaigns or initiatives to keep minimum wage-related topics at the forefront. This can include posters, newsletters, or intranet articles highlighting key aspects of minimum wage laws.

- Individual Counseling: Offer individual counseling sessions for employees who have specific concerns or questions related to their wages. Provide personalized guidance and support to address their queries effectively.

- Employee Handbook: Develop an employee handbook that outlines minimum wage laws, wage structures, and the organization’s policies. Ensure that it is easily accessible and regularly updated.

Strategy 8: Monitor Overtime and Hours Worked

Effective management of overtime and hours worked is crucial to ensure compliance with minimum wage laws:

- Overtime Policies: Establish clear overtime policies that define when overtime is authorized, the procedures for requesting overtime, and the compensation rates. Ensure that these policies comply with legal requirements.

- Regularly Review Hours Worked: Regularly review and analyze hours worked by employees to identify any potential violations of minimum wage laws. Address any discrepancies promptly to maintain compliance.

- Limit Excessive Overtime: Implement measures to prevent excessive overtime, as it may impact employee well-being and productivity. Encourage a healthy work-life balance and provide support to employees who need assistance in managing their workload.

- Compensatory Time Off: Consider offering compensatory time off as an alternative to overtime pay. This allows employees to take time off in lieu of overtime hours worked, ensuring a fair balance between work and personal life.

Strategy 9: Build a Culture of Compliance

Creating a culture of compliance within your organization is essential for effective minimum wage management:

- Leadership Commitment: Demonstrate a strong commitment to compliance from the top leadership. Ensure that all managers and supervisors understand the importance of adhering to minimum wage laws and lead by example.

- Ethical Business Practices: Foster an ethical work environment that promotes integrity and compliance. Encourage employees to report any potential violations or concerns related to minimum wage management.

- Code of Conduct: Develop a comprehensive code of conduct that outlines the organization’s values, ethical standards, and expectations regarding minimum wage compliance. Ensure that all employees are aware of and adhere to this code.

- Regular Compliance Training: Conduct regular training sessions focused on compliance, including minimum wage laws, anti-discrimination policies, and ethical practices. Reinforce the importance of compliance and the potential consequences of non-compliance.

Strategy 10: Conduct Regular Performance Evaluations

Regular performance evaluations are crucial for fair wage management and employee motivation:

- Set Clear Performance Standards: Establish clear and measurable performance standards for each job role. These standards should be aligned with the organization’s goals and values, providing a fair basis for performance evaluation.

- Regular Feedback Sessions: Schedule regular feedback sessions with employees to discuss their performance, set goals, and provide constructive feedback. This ensures that employees understand their strengths and areas for improvement.

- Link Performance to Wage Increases: Tie wage increases to employee performance. Reward exceptional performance with performance-based bonuses or salary increments. This motivates employees and reinforces the connection between hard work and compensation.

- Employee Development Plans: Develop personalized development plans for employees based on their performance evaluations. These plans can include training programs, mentorship opportunities, or skill enhancement initiatives to support their growth.

Conclusion

Minimum wage management is a critical aspect of running a successful and compliant business. By implementing these ten powerful strategies, you can ensure fair and equitable wage practices, foster a positive work environment, and maintain compliance with legal requirements. Remember, effective minimum wage management requires a combination of knowledge, technology, and a commitment to ethical business practices. Stay updated, communicate openly, and prioritize the well-being of your employees to create a thriving and prosperous organization.

FAQ

What are the consequences of non-compliance with minimum wage laws?

+

Non-compliance with minimum wage laws can result in severe legal consequences, including fines, penalties, and legal actions. Employers may face civil lawsuits, back wage payments, and damage to their reputation. It is crucial to prioritize compliance to avoid these negative outcomes.

How often should I review and update my wage policy?

+

It is recommended to review and update your wage policy at least annually, or more frequently if there are significant changes in minimum wage laws or market trends. Regular reviews ensure that your wage practices remain competitive, fair, and compliant.

Can I offer incentives or bonuses that exceed the minimum wage rate?

+

Yes, you can offer incentives or bonuses that exceed the minimum wage rate. However, it is essential to ensure that these incentives do not violate any other labor laws or regulations. Consult legal experts to structure performance-based incentives fairly and compliantly.

How can I encourage employees to report wage-related concerns or violations?

+

Creating a safe and confidential reporting environment is crucial. Ensure that employees are aware of the organization’s commitment to compliance and provide multiple channels for reporting, such as anonymous hotlines or feedback mechanisms. Regularly communicate the importance of reporting and assure employees of confidentiality and protection against retaliation.

What are some best practices for conducting performance evaluations related to minimum wage management?

+

Best practices for performance evaluations include setting clear and measurable performance standards, providing regular feedback, and involving employees in the goal-setting process. Linking performance to wage increases and providing development opportunities further motivates employees and enhances their commitment to the organization.