20+ Ebt Examples: A Comprehensive Showcase For Your Business

Exploring the world of Electronic Benefits Transfer (EBT) solutions, we delve into a collection of over 20 practical examples that showcase the versatility and impact of EBT in various business contexts. From streamlining payment processes to enhancing customer experiences, these examples demonstrate the potential of EBT to revolutionize the way businesses operate and engage with their audience.

EBT in Retail: Enhancing the Shopping Experience

In the retail sector, EBT offers a range of benefits. One notable example is the implementation of EBT for loyalty programs. By integrating EBT with loyalty systems, retailers can provide customers with a seamless experience, allowing them to earn and redeem rewards effortlessly. This not only encourages customer loyalty but also simplifies the management of loyalty initiatives for businesses.

Additionally, EBT can be utilized for gift card programs, providing a convenient and secure way for customers to purchase and redeem gift cards. This not only enhances the gift-giving experience but also offers retailers an opportunity to boost sales and promote brand awareness.

EBT in Healthcare: Streamlining Patient Payments

The healthcare industry stands to gain significant advantages from EBT implementation. One notable application is the use of EBT for patient co-pays. By accepting EBT for co-payments, healthcare providers can offer patients a more accessible and convenient payment method, reducing the administrative burden associated with traditional payment processes.

Furthermore, EBT can be leveraged for insurance claims and reimbursements. This streamlines the often complex process of insurance claim settlements, ensuring a smoother experience for both patients and healthcare providers.

EBT in Education: Simplifying Tuition Payments

The education sector can greatly benefit from EBT solutions. For instance, EBT can be utilized for tuition payments, providing a secure and efficient way for students and their families to manage education-related expenses. This not only simplifies the payment process but also reduces the administrative overhead for educational institutions.

Additionally, EBT can be applied to student loan repayments, offering a convenient and flexible repayment option for graduates. This not only enhances the overall student loan experience but also promotes financial inclusivity.

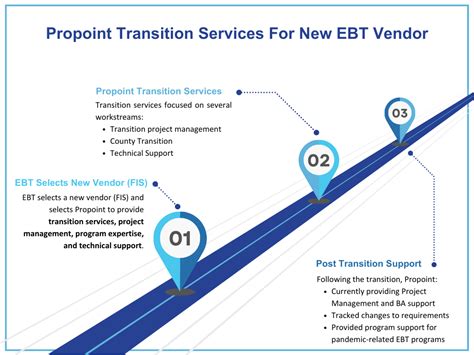

EBT in Government Services: Efficient Benefit Distribution

Government agencies can leverage EBT to streamline the distribution of benefits to eligible citizens. One notable example is the use of EBT for food assistance programs, such as the Supplemental Nutrition Assistance Program (SNAP). By utilizing EBT, governments can ensure a more efficient and secure distribution of food benefits, improving the overall effectiveness of these programs.

EBT can also be employed for other government benefit programs, such as housing assistance and energy assistance. This enables a more streamlined and accessible delivery of benefits, contributing to the overall well-being of the community.

EBT in Transportation: Transforming Commute Payments

The transportation industry can benefit significantly from EBT implementation. For instance, EBT can be utilized for transit passes, providing commuters with a convenient and secure way to pay for their daily travel. This not only enhances the overall commuting experience but also promotes the use of public transportation.

Additionally, EBT can be applied to parking payments, offering a more efficient and cashless option for drivers. This not only streamlines the parking process but also reduces the administrative tasks associated with traditional parking payment methods.

EBT in Hospitality: Enhancing Guest Experiences

The hospitality industry can leverage EBT to create a more personalized and efficient guest experience. One example is the use of EBT for hotel room charges. By accepting EBT, hotels can offer guests a seamless and secure way to pay for their stay, enhancing overall guest satisfaction.

Furthermore, EBT can be utilized for restaurant payments, providing diners with a convenient and modern payment option. This not only speeds up the payment process but also contributes to a more enjoyable dining experience.

EBT in Entertainment: Revolutionizing Event Payments

The entertainment industry can greatly benefit from EBT solutions. For instance, EBT can be employed for event tickets, offering a secure and efficient way for event organizers to manage ticket sales and payments. This not only simplifies the ticketing process but also enhances the overall event experience for attendees.

Additionally, EBT can be used for concession sales at entertainment venues, providing a more streamlined and cashless payment option for guests. This not only speeds up concession transactions but also reduces the risk of cash-related issues.

EBT in Financial Services: Empowering Digital Payments

Financial institutions can leverage EBT to enhance their digital payment offerings. One example is the use of EBT for peer-to-peer payments, allowing individuals to send and receive money securely and efficiently. This not only promotes financial inclusivity but also provides a modern and convenient payment option for users.

Furthermore, EBT can be applied to bill payments, offering a more accessible and streamlined way for individuals to manage their utility and service bills. This not only simplifies the payment process but also contributes to a more organized financial management system.

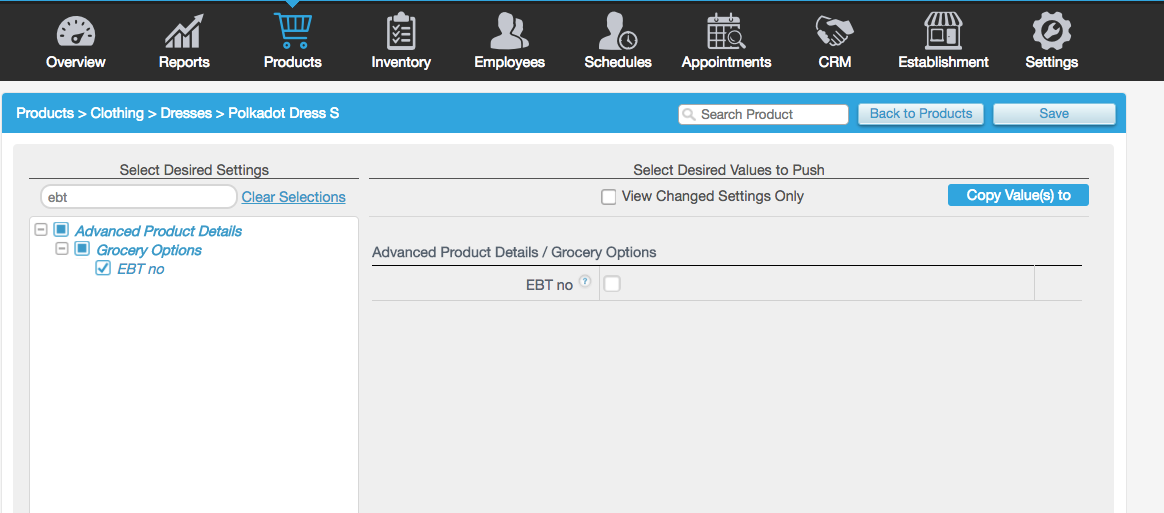

EBT in E-commerce: Securing Online Transactions

E-commerce businesses can benefit from EBT implementation to enhance the security and efficiency of online transactions. One notable example is the use of EBT for online shopping, providing customers with a secure and familiar payment method. This not only builds trust with online shoppers but also reduces the risk of fraud and chargebacks.

Additionally, EBT can be utilized for subscription payments, offering a seamless and automated way for customers to manage their recurring payments. This not only simplifies the subscription process but also ensures a more reliable revenue stream for e-commerce businesses.

EBT in Real Estate: Streamlining Rental Payments

The real estate industry can leverage EBT to streamline the rental payment process. One example is the use of EBT for rent payments, providing tenants with a secure and convenient way to pay their rent. This not only simplifies the payment process but also reduces the administrative burden for property managers.

Furthermore, EBT can be applied to security deposits, offering a more transparent and secure way to manage these funds. This not only enhances the overall rental experience but also contributes to a more professional and organized real estate management system.

EBT in Non-profit Organizations: Efficient Fundraising

Non-profit organizations can benefit significantly from EBT implementation for their fundraising efforts. One notable example is the use of EBT for donation payments, providing donors with a secure and convenient way to contribute to a cause. This not only simplifies the donation process but also encourages more people to support charitable initiatives.

Additionally, EBT can be employed for event registrations and ticket sales for charity events, streamlining the event management process and increasing attendance.

EBT in Agriculture: Supporting Farmers' Markets

The agriculture industry can leverage EBT to support local farmers and promote healthy eating. One example is the use of EBT for farmers' market sales, providing a convenient and accessible way for consumers to purchase fresh produce. This not only benefits farmers but also encourages a healthier lifestyle for the community.

Furthermore, EBT can be utilized for community-supported agriculture (CSA) programs, offering a secure and efficient way for consumers to support local agriculture and receive fresh produce in return.

EBT in Art and Culture: Enabling Creative Pursuits

The art and culture sector can benefit from EBT implementation to support creative endeavors. One example is the use of EBT for art gallery admissions, providing a convenient and secure way for art enthusiasts to access cultural spaces. This not only enhances the overall cultural experience but also contributes to the sustainability of art institutions.

Additionally, EBT can be applied to funding for creative projects, offering a modern and accessible way for artists and creators to secure the necessary resources for their work.

EBT in Environmental Initiatives: Promoting Sustainability

Environmental organizations and initiatives can leverage EBT to promote sustainable practices. One example is the use of EBT for eco-friendly product purchases, providing a secure and convenient way for consumers to support environmentally conscious brands. This not only contributes to a greener economy but also raises awareness about sustainable living.

Furthermore, EBT can be utilized for carbon offset programs, offering a transparent and efficient way for individuals to contribute to carbon reduction efforts.

EBT in Social Enterprises: Driving Social Impact

Social enterprises can benefit from EBT implementation to drive their social impact goals. One example is the use of EBT for social impact investments, providing a secure and efficient way for investors to support socially responsible businesses. This not only promotes financial inclusivity but also contributes to positive social change.

Additionally, EBT can be employed for microfinance initiatives, offering a modern and accessible way to provide financial services to underserved communities.

EBT in International Remittances: Secure Cross-Border Payments

EBT can be utilized for international remittances, providing a secure and efficient way for individuals to send money across borders. This not only facilitates cross-border payments but also reduces the reliance on traditional remittance methods, which can be costly and time-consuming.

EBT in Digital Currencies: Embracing the Future of Money

As digital currencies gain popularity, EBT can be adapted to support these emerging payment methods. By integrating EBT with digital wallets and blockchain technology, businesses can offer a more inclusive and future-proof payment experience. This not only caters to the evolving preferences of consumers but also positions businesses at the forefront of financial innovation.

EBT in B2B Transactions: Streamlining Business Payments

EBT can be leveraged to streamline business-to-business (B2B) transactions, offering a more efficient and secure way for businesses to manage their payments and invoices. This not only reduces administrative overhead but also strengthens relationships between businesses by providing a more reliable and transparent payment system.

EBT in Customer Loyalty: Building Long-Term Relationships

EBT can be utilized to enhance customer loyalty programs, providing a more personalized and rewarding experience for customers. By offering exclusive discounts, rewards, and experiences through EBT, businesses can foster a sense of loyalty and encourage repeat business. This not only boosts customer retention but also contributes to a more profitable and sustainable business model.

EBT in Data-Driven Insights: Unlocking Business Intelligence

The data generated through EBT transactions can provide valuable insights for businesses. By analyzing spending patterns, customer behavior, and market trends, businesses can make more informed decisions and develop targeted strategies. This data-driven approach not only enhances business intelligence but also enables businesses to stay ahead of the competition.

EBT in Personal Finance Management: Empowering Individuals

EBT can be a powerful tool for individuals to manage their personal finances more effectively. By offering a secure and centralized platform for various payment methods, EBT can help individuals stay on top of their expenses, track their spending, and make more informed financial decisions. This not only promotes financial literacy but also empowers individuals to take control of their financial well-being.

EBT in Mobile Payments: Embracing the Digital Age

With the rise of mobile technology, EBT can be seamlessly integrated into mobile payment solutions. By offering a secure and convenient way to make payments on the go, EBT can enhance the overall user experience and cater to the growing preference for mobile payments. This not only keeps businesses relevant in the digital age but also provides a more efficient and accessible payment option for customers.

EBT in Financial Inclusion: Bridging the Gap

EBT has the potential to bridge the gap in financial inclusion, particularly in underserved communities. By offering a secure and accessible payment method, EBT can provide individuals with limited access to traditional banking services with a means to participate in the digital economy. This not only promotes financial inclusion but also empowers individuals to pursue economic opportunities.

Conclusion

The diverse range of EBT examples presented here showcases the immense potential of this technology to transform various industries and enhance the way businesses operate. From retail to healthcare, education to entertainment, EBT offers a secure, efficient, and inclusive payment solution that caters to the evolving needs of businesses and their customers. By embracing EBT, businesses can not only streamline their payment processes but also create a more engaging and personalized experience for their audience, ultimately driving growth and success.

What is EBT and how does it work?

+EBT, or Electronic Benefits Transfer, is a secure electronic payment system used to distribute government benefits, such as food assistance and cash benefits, to eligible recipients. It works by transferring funds electronically from a government-issued EBT card to a merchant’s point-of-sale (POS) system, allowing beneficiaries to make purchases using their benefits.

What are the benefits of implementing EBT for businesses?

+Implementing EBT offers businesses several advantages, including increased sales, improved cash flow, reduced administrative burdens, and enhanced customer satisfaction. EBT provides a secure and efficient payment method, attracting more customers and streamlining the payment process.

How can EBT be used in different industries?

+EBT can be utilized across various industries, such as retail, healthcare, education, and hospitality. For example, in retail, EBT can be used for loyalty programs and gift cards. In healthcare, it can streamline patient co-pays and insurance claims. In education, EBT can facilitate tuition payments, and in hospitality, it can enhance the guest experience by accepting EBT for hotel room charges and restaurant payments.

Is EBT secure and reliable?

+Yes, EBT is designed with robust security measures to protect the confidentiality and integrity of transactions. It utilizes encryption and other security protocols to safeguard personal and financial information. Additionally, EBT systems are regularly monitored and updated to ensure their reliability and prevent fraud.

How can businesses get started with EBT acceptance?

+To begin accepting EBT, businesses need to obtain an EBT merchant account and install compatible point-of-sale (POS) equipment. This may involve working with a payment processor or acquiring a merchant ID. Businesses should also familiarize themselves with EBT acceptance guidelines and ensure their staff is trained to handle EBT transactions efficiently.