9 Instant Steps To Create Your Pro Pebt Schedule Now

Creating a professional pebt schedule is an essential task for anyone looking to manage their finances effectively. Whether you're an individual, a small business owner, or a financial planner, having a well-organized pebt schedule can help you stay on top of your financial obligations and make informed decisions. In this blog post, we will guide you through a series of instant steps to create your pebt schedule, ensuring a seamless and efficient process.

Step 1: Gather Relevant Information

Before diving into the creation of your pebt schedule, it’s crucial to gather all the necessary information. Start by collecting details about your existing debts, including the type of debt (e.g., credit card, student loan, mortgage), the outstanding balance, interest rates, and minimum monthly payments.

Step 2: Prioritize Your Debts

Not all debts are created equal, and prioritizing them is essential. Consider factors such as interest rates, the impact of late payments, and the overall impact on your credit score. Create a list of your debts in order of priority, with the highest interest rate or most urgent debt at the top.

Step 3: Determine Your Monthly Budget

Understanding your monthly budget is vital to creating an effective pebt schedule. Calculate your monthly income and expenses, including fixed costs like rent or mortgage payments, utilities, and variable expenses such as groceries and entertainment. This will help you allocate funds towards your debt repayment.

Step 4: Choose a Repayment Strategy

There are several popular repayment strategies to consider. The debt snowball method focuses on paying off smaller debts first, boosting motivation. On the other hand, the debt avalanche method prioritizes debts with the highest interest rates, saving you money in the long run. Choose the strategy that aligns with your financial goals and preferences.

Step 5: Create a Payment Plan

Based on your chosen repayment strategy, create a detailed payment plan. Assign specific amounts to each debt, ensuring that you meet the minimum monthly payments. If possible, allocate extra funds towards the highest-priority debts to accelerate repayment.

Step 6: Automate Your Payments

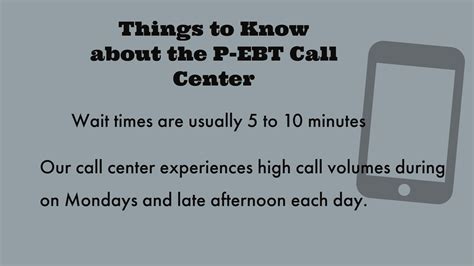

To ensure timely payments and avoid late fees, consider automating your debt repayments. Set up automatic payments through your bank or the lenders’ websites. This way, you can rest assured that your payments are made on time, every time.

Step 7: Track Your Progress

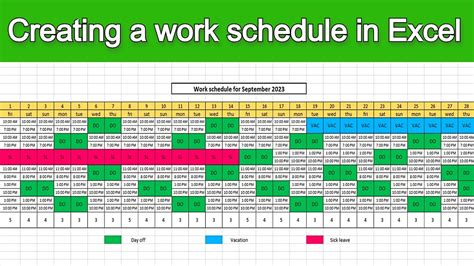

Regularly monitor your pebt schedule to stay on track. Update your records after each payment, reflecting the reduced balance and any changes in interest rates. Consider using a spreadsheet or a dedicated financial app to keep an accurate record of your progress.

Step 8: Optimize Your Repayment

As you make progress, look for opportunities to optimize your repayment strategy. Refinance high-interest debts to secure lower interest rates or explore debt consolidation options. By reducing the overall interest burden, you can accelerate your journey to becoming debt-free.

Step 9: Celebrate Milestones

Creating a pebt schedule is a significant financial achievement, so don’t forget to celebrate your milestones! Whether it’s paying off a small debt or reaching a significant repayment goal, acknowledge your progress and reward yourself accordingly. This will keep you motivated throughout your financial journey.

Notes

🌟 Note: Remember, creating a pebt schedule is a personalized process. Tailor your strategy to your unique financial situation and goals. Stay disciplined, and you’ll be on the path to financial freedom in no time!

FAQ

What is a pebt schedule, and why is it important?

+A pebt schedule is a comprehensive plan outlining your debt repayment strategy. It helps you manage your finances effectively, stay on top of payments, and work towards becoming debt-free. By creating a pebt schedule, you gain control over your financial obligations and can make informed decisions to improve your financial well-being.

How often should I update my pebt schedule?

+It’s recommended to review and update your pebt schedule regularly, ideally on a monthly basis. This allows you to track your progress, adjust your repayment strategy if needed, and stay aligned with your financial goals. Additionally, updating your schedule whenever there are significant changes in your debt or income can help you stay on top of your financial plan.

Can I use a financial app to create and manage my pebt schedule?

+Absolutely! There are several financial apps available that can assist you in creating and managing your pebt schedule. These apps often provide features like debt tracking, repayment planning, and automated payment reminders. Using a financial app can make the process more convenient and help you stay organized throughout your debt repayment journey.

Conclusion

Creating a pebt schedule is a powerful step towards achieving financial freedom. By following these instant steps, you can take control of your debts, prioritize your repayment strategy, and work towards a brighter financial future. Remember, staying disciplined, tracking your progress, and celebrating milestones along the way will keep you motivated and on the right path. With a well-organized pebt schedule, you’ll be able to make informed financial decisions and achieve your goals with confidence.