Design The Perfect Ebt Experience: A Pro's Guide

Creating an efficient and user-friendly Electronic Benefits Transfer (EBT) experience is crucial for any business or organization dealing with government-issued benefits. An EBT system streamlines the process of accessing and utilizing these benefits, ensuring a seamless experience for both customers and administrators. In this guide, we'll delve into the key steps and considerations to design an exceptional EBT experience, covering everything from initial setup to ongoing management and troubleshooting.

Understanding EBT and Its Benefits

EBT, or Electronic Benefits Transfer, is a system that enables the distribution of government benefits, such as food stamps (SNAP) and cash benefits, in a secure and efficient manner. It offers numerous advantages over traditional paper-based systems, including reduced fraud, improved accuracy, and enhanced convenience for both recipients and administrators.

By implementing an EBT system, businesses and organizations can streamline their operations, reduce administrative burdens, and provide a more accessible and user-friendly experience for their customers. Let's explore the essential steps to design and maintain an effective EBT experience.

Step 1: EBT Card Setup and Issuance

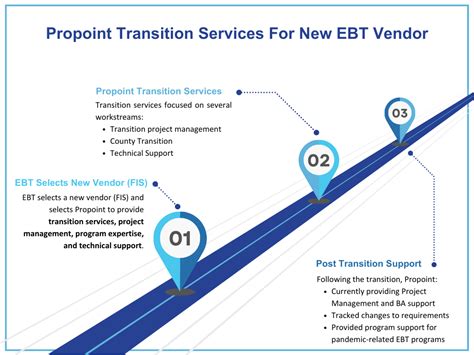

The first step in designing an EBT experience is setting up the EBT cards themselves. This involves partnering with an EBT card vendor or processor who will provide the physical cards and the necessary infrastructure to support the system. Ensure that the chosen vendor complies with all relevant regulations and offers robust security measures to protect sensitive data.

During the card setup process, consider the following:

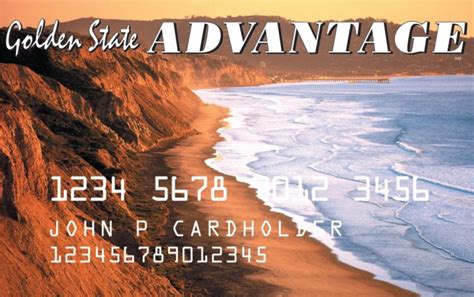

- Card Design: Opt for a card design that is visually appealing and easy to recognize. This can help customers quickly identify their EBT card among other cards in their wallet.

- Personalization: Include personalized details on the card, such as the recipient's name and unique identification number. This adds an extra layer of security and helps prevent fraud.

- Activation Process: Establish a straightforward activation process for new cardholders. This should involve minimal steps and clear instructions to ensure a smooth activation experience.

Step 2: EBT Account Creation and Management

Once the EBT cards are set up, the next step is to create and manage the associated EBT accounts. This involves establishing a secure online platform where customers can access their account information, view transaction history, and manage their benefits.

Key considerations for EBT account creation and management include:

- User-Friendly Interface: Design an intuitive and user-friendly interface for the EBT account platform. Ensure that navigation is straightforward and that all necessary information is easily accessible.

- Secure Login: Implement robust security measures, such as two-factor authentication, to protect customer accounts and prevent unauthorized access.

- Account Customization: Allow customers to customize their account settings, such as preferred language, notification preferences, and personal information.

- Account Recovery: Develop a comprehensive account recovery process to assist customers who may have forgotten their login credentials or need to regain access to their accounts.

Step 3: EBT Transaction Processing

Efficient transaction processing is crucial for a seamless EBT experience. This step involves setting up the necessary infrastructure to process EBT transactions securely and accurately.

Consider the following when establishing EBT transaction processing:

- Payment Terminals: Ensure that your business or organization has the necessary payment terminals or point-of-sale (POS) systems to accept EBT payments. These terminals should be EBT-certified and comply with all relevant regulations.

- Transaction Security: Implement robust security measures to protect EBT transactions, such as encryption and tokenization. This helps prevent fraud and ensures the confidentiality of sensitive data.

- Real-Time Processing: Aim for real-time transaction processing to provide instant feedback to customers and minimize wait times.

- Transaction History: Provide customers with a detailed transaction history within their EBT accounts, allowing them to track their spending and manage their benefits effectively.

Step 4: EBT Customer Support and Education

Offering comprehensive customer support and education is essential to ensure a positive EBT experience. This step involves establishing a dedicated support team and developing resources to assist customers with any EBT-related queries or issues.

Key elements of EBT customer support and education include:

- Help Desk: Set up a dedicated help desk or customer support team to address EBT-related inquiries. Ensure that support staff are well-trained and knowledgeable about the EBT system and its features.

- Online Resources: Create a comprehensive online knowledge base or FAQ section on your website, providing answers to common EBT-related questions. This can include step-by-step guides, troubleshooting tips, and contact information for further assistance.

- Training Materials: Develop training materials or tutorials for customers, especially those who may be new to the EBT system. These materials should cover topics such as card activation, account management, and transaction processing.

- Community Engagement: Engage with your customer community through social media, forums, or other online platforms. This can help identify common pain points and allow you to address them proactively.

Step 5: EBT Security and Fraud Prevention

Maintaining a secure EBT system is paramount to protecting sensitive data and preventing fraud. This step involves implementing robust security measures and regularly monitoring the system for any suspicious activities.

Consider the following to enhance EBT security:

- Data Encryption: Ensure that all data transmitted during EBT transactions is encrypted to protect sensitive information from unauthorized access.

- Transaction Monitoring: Implement real-time transaction monitoring to detect and flag any suspicious activities or potential fraud attempts.

- Fraud Prevention Measures: Collaborate with your EBT card vendor or processor to implement additional fraud prevention measures, such as advanced authentication methods or behavioral analytics.

- Regular Security Audits: Conduct regular security audits and penetration testing to identify and address any vulnerabilities in your EBT system.

Step 6: EBT Reporting and Analytics

EBT reporting and analytics provide valuable insights into the performance and usage of your EBT system. This step involves setting up a robust reporting infrastructure to generate meaningful reports and analyze EBT data.

Key aspects of EBT reporting and analytics include:

- Reporting Tools: Implement reporting tools that allow you to generate comprehensive reports on EBT transactions, customer behavior, and system performance. These reports should be easily customizable and accessible to relevant stakeholders.

- Data Analysis: Utilize data analysis techniques to identify trends, patterns, and areas for improvement within your EBT system. This can help optimize the user experience and enhance overall efficiency.

- Performance Monitoring: Continuously monitor the performance of your EBT system to identify any bottlenecks or areas that require optimization. This can involve tracking transaction speeds, system uptime, and customer satisfaction metrics.

Step 7: EBT System Maintenance and Updates

Regular maintenance and updates are essential to keep your EBT system running smoothly and securely. This step involves establishing a maintenance schedule and implementing any necessary system updates or upgrades.

Consider the following for EBT system maintenance and updates:

- Maintenance Schedule: Develop a comprehensive maintenance schedule that includes regular system backups, software updates, and hardware maintenance. Ensure that maintenance activities are conducted during off-peak hours to minimize disruption to customers.

- System Updates: Stay up-to-date with the latest EBT system updates and patches to address any security vulnerabilities or performance issues. Collaborate with your EBT card vendor or processor to ensure timely implementation of these updates.

- Disaster Recovery Plan: Establish a robust disaster recovery plan to minimize downtime and data loss in the event of system failures or natural disasters. This plan should include backup strategies, data redundancy, and procedures for resuming EBT operations.

Step 8: EBT Compliance and Regulatory Requirements

EBT systems are subject to various compliance and regulatory requirements to ensure the secure and proper handling of government benefits. This step involves staying informed about these requirements and implementing necessary measures to remain compliant.

Key compliance considerations include:

- Regulatory Compliance: Stay up-to-date with federal, state, and local regulations governing EBT systems. This includes understanding and adhering to rules related to data privacy, security, and benefit distribution.

- Data Privacy: Implement robust data privacy measures to protect customer information. This may involve obtaining customer consent for data collection and processing, as well as providing options for data deletion or rectification.

- Audits and Inspections: Cooperate with regulatory authorities during audits and inspections to demonstrate your commitment to compliance and ensure the smooth operation of your EBT system.

Step 9: EBT Customer Onboarding and Training

Effective customer onboarding and training are crucial to ensure that new EBT users can navigate the system with ease. This step involves developing comprehensive training materials and providing support during the onboarding process.

Consider the following for EBT customer onboarding and training:

- Onboarding Process: Develop a streamlined onboarding process that guides new EBT users through the steps of activating their cards, creating their accounts, and understanding the basic functionality of the system.

- Training Materials: Create training materials, such as tutorials, videos, or step-by-step guides, to assist new users in familiarizing themselves with the EBT system. These materials should be easily accessible and available in multiple formats to accommodate different learning styles.

- Personalized Support: Offer personalized support to new users, especially those who may require additional assistance. This can include one-on-one training sessions, live chat support, or dedicated helplines.

Step 10: EBT System Integration and Interoperability

Integrating your EBT system with other existing systems and platforms can enhance its functionality and streamline operations. This step involves establishing connections with relevant systems and ensuring seamless interoperability.

Consider the following for EBT system integration and interoperability:

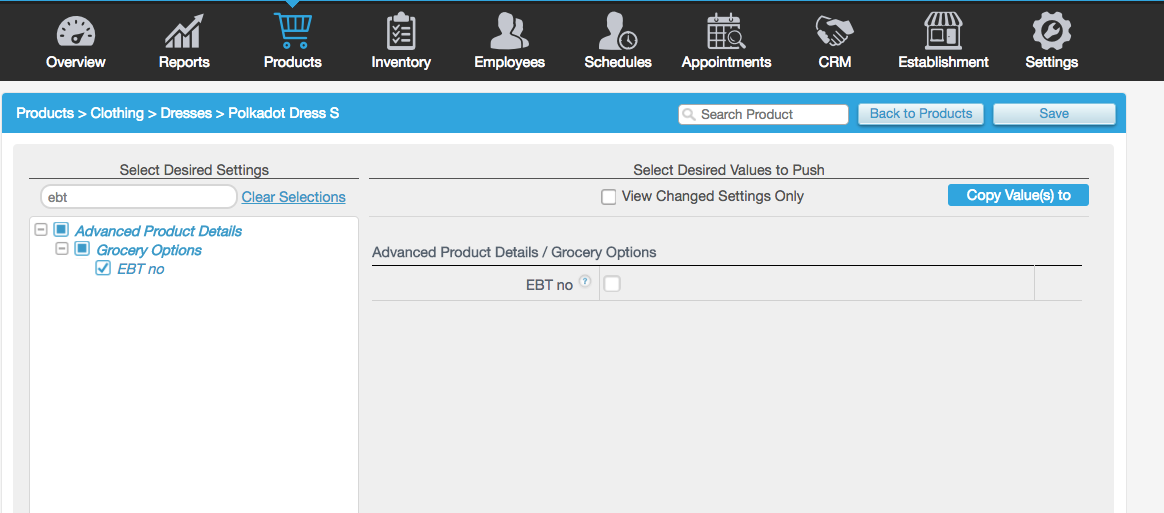

- System Integration: Identify and prioritize the systems or platforms that would benefit from integration with your EBT system. This may include accounting software, inventory management systems, or loyalty programs.

- API Integration: Utilize APIs (Application Programming Interfaces) to facilitate seamless data exchange between your EBT system and other integrated systems. Ensure that all APIs are secure and compliant with relevant standards.

- Data Synchronization: Establish a robust data synchronization process to ensure that data across integrated systems remains consistent and up-to-date. This helps prevent errors and ensures a seamless user experience.

Step 11: EBT Customer Feedback and Improvement

Collecting and acting upon customer feedback is essential to continuously improve your EBT system and enhance the user experience. This step involves establishing feedback mechanisms and implementing changes based on customer insights.

Consider the following for EBT customer feedback and improvement:

- Feedback Channels: Establish multiple channels for customers to provide feedback, such as online surveys, feedback forms, or direct communication with support staff. Ensure that these channels are easily accessible and encourage customers to share their thoughts and suggestions.

- Feedback Analysis: Analyze customer feedback to identify common pain points, areas for improvement, and potential new features. Use this information to prioritize and implement changes that will enhance the overall EBT experience.

- User Testing: Conduct user testing sessions to gather real-time feedback and observations from a diverse range of EBT users. This can help identify usability issues, design flaws, or areas where the system can be simplified.

Step 12: EBT System Scalability and Growth

As your EBT system gains traction and usage grows, it's important to ensure that it can scale effectively to accommodate increased demand. This step involves planning for future growth and implementing measures to enhance system scalability.

Consider the following for EBT system scalability and growth:

- Scalability Planning: Develop a scalability plan that outlines the steps and resources required to accommodate a growing user base. This may involve upgrading hardware, optimizing database performance, or implementing load-balancing techniques.

- Performance Optimization: Continuously monitor and optimize the performance of your EBT system to ensure it can handle increased transaction volumes and user traffic. This may involve adjusting server configurations, implementing caching mechanisms, or utilizing content delivery networks (CDNs).

- System Redundancy: Implement system redundancy measures to ensure that your EBT system remains available even in the event of hardware failures or other disruptions. This can involve setting up backup servers, utilizing cloud-based infrastructure, or employing disaster recovery solutions.

Step 13: EBT System Security Audits and Penetration Testing

Regular security audits and penetration testing are crucial to identify and address potential vulnerabilities in your EBT system. This step involves conducting comprehensive security assessments to ensure the ongoing protection of sensitive data and the overall integrity of the system.

Consider the following for EBT system security audits and penetration testing:

- Security Audits: Engage independent security experts or consulting firms to conduct comprehensive security audits of your EBT system. These audits should cover all aspects of the system, including network infrastructure, application security, and data storage.

- Penetration Testing: Perform regular penetration testing to simulate real-world attack scenarios and identify potential vulnerabilities. This involves engaging ethical hackers or security professionals to attempt to breach the system and exploit any weaknesses.

- Remediation and Patching: Based on the findings of security audits and penetration testing, implement the necessary remediation measures and apply security patches to address identified vulnerabilities. This ensures that your EBT system remains secure and resilient against potential threats.

Step 14: EBT System Uptime and Reliability

Maintaining high system uptime and reliability is essential to ensure a seamless EBT experience for your customers. This step involves implementing measures to minimize downtime and ensure the continuous availability of your EBT system.

Consider the following for EBT system uptime and reliability:

- Redundancy and Failover: Implement redundancy measures, such as backup servers or data centers, to ensure that your EBT system can continue operating even in the event of hardware failures or other disruptions. This helps minimize downtime and maintain system availability.

- Monitoring and Alerting: Utilize monitoring tools and systems to continuously track the performance and health of your EBT system. Set up alerts and notifications to promptly identify and address any issues that may impact system uptime or reliability.

- Disaster Recovery: Develop a comprehensive disaster recovery plan that outlines the steps to be taken in the event of a system failure or natural disaster. This plan should include backup strategies, data redundancy, and procedures for resuming EBT operations in a timely manner.

Step 15: EBT System Performance Optimization

Optimizing the performance of your EBT system is crucial to provide a fast and responsive user experience. This step involves implementing various techniques and best practices to enhance system performance and ensure smooth transactions.

Consider the following for EBT system performance optimization:

- Server Optimization: Optimize your server infrastructure to handle high transaction volumes and user traffic. This may involve upgrading hardware, optimizing database performance, or implementing load-balancing techniques to distribute the workload across multiple servers.

- Caching and Content Delivery: Implement caching mechanisms and content delivery networks (CDNs) to reduce the load on your servers and improve response times. Caching stores frequently accessed data in memory, while CDNs distribute content to edge servers closer to users, resulting in faster delivery.

- Application Performance Monitoring: Utilize application performance monitoring tools to track and analyze the performance of your EBT system. These tools can help identify bottlenecks, slow-performing components, or areas where optimization can be achieved.

Step 16: EBT System Usability and User Experience

Creating a user-friendly and intuitive EBT system is essential to ensure a positive user experience. This step involves focusing on usability and user experience design to make the system easy to navigate and understand.

Consider the following for EBT system usability and user experience:

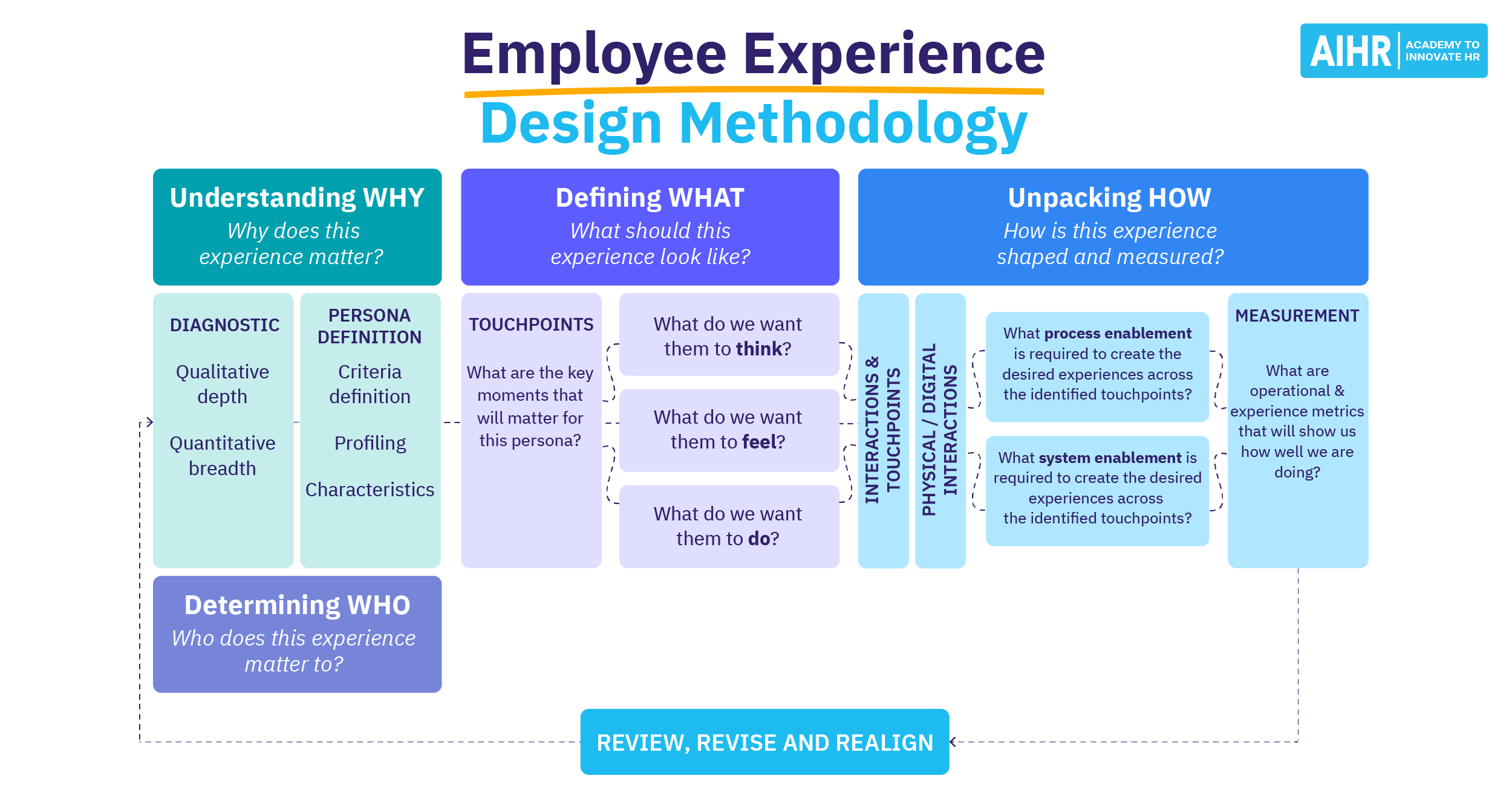

- User-Centric Design: Adopt a user-centric design approach, where the needs and preferences of your target audience are at the forefront of the design process. Conduct user research, usability testing, and gather feedback to iteratively improve the user experience.

- Simplified Navigation: Ensure that the navigation structure of your EBT system is intuitive and easy to follow. Use clear and concise labels, minimize the number of clicks required to access important features, and provide helpful breadcrumbs or progress indicators.

- Responsive Design: Implement a responsive design approach to ensure that your EBT system is accessible and usable across different devices and screen sizes. This includes optimizing the layout, typography, and interactivity to provide a seamless experience on desktops, laptops, tablets, and mobile devices.

Step 17: EBT System Accessibility and Inclusivity

Making your EBT system accessible and inclusive is crucial to ensure that it can be used by individuals with disabilities or special needs. This step involves implementing accessibility